tulsa oklahoma auto sales tax

If the purchased price falls within 20 of the. The state sales tax rate in Oklahoma is 4500.

Car Sales Tax In Oklahoma Getjerry Com

Just the 325 excise tax.

. The Tulsa sales tax rate is. CORY YOUNGTulsa World file. Tulsa Oklahoma Auto Sales Tax.

The actual excise tax value is based on the Blue Book value as established by the Vehicle Identification Number VIN. For vehicles that are being rented or leased see see taxation of leases and rentals. Vehicles sit on the lot at a Tulsa dealership.

See reviews photos directions phone numbers and more for the best Taxes-Consultants Representatives in Tulsa OK. New and used all-terrain vehicles utility vehicles and off road motorcycles. The City has five major tax categories and collectively they provide 52 of the projected revenue.

Excise tax on boats and outboard motors is based on the manufacturers original retail selling price of the unit. Motor vehicle taxes in Oklahoma are both selective sales taxes on the purchase of vehicles and ongoing taxes on wealth the value of the vehicles. The value of a vehicle is its actual sales price.

IRP IFTA 100 percent Disabled Veterans Sales Tax Exemption Motor Vehicle Exemption Ad Valorem Exemption E-File Free File Businesses Tax. Oklahoma does not charge a sales tax on cars. So dont expect to pay 8 sales tax.

325 of 65 of ½ the actual purchase pricecurrent value. The sales tax rate for the Sooner City is 45 however for most road vehicles there is a Motor Vehicles Excise Tax assessed at the time of sale or when the new Oklahoma car title is issued in the new owners name. This is the largest of Oklahomas selective sales taxes in terms of revenue generated.

325 of 65 of ½ the actual purchase pricecurrent value. Sales tax at 365 2 to general fund. The minimum combined 2022 sales tax rate for Tulsa Oklahoma is.

The Oklahoma sales tax rate is currently. Sales Tax in Tulsa. OKLAHOMA CITY The Oklahoma Supreme Court on Thursday ruled that a 125 percent sales tax on vehicles was not a tax.

This is the total of state county and city sales tax rates. Whether you live in Tulsa Broken Bow or Oklahoma City residents are required to pay Oklahoma car tax when purchasing a vehicle. The excise tax IS 325 and cars are not assessed sales tax at least on the line item.

325 of ½ the actual purchase pricecurrent value. The tulsa county sales tax rate is. The annual registration fee for non-commercial vehicles ranges from 15 to 85 depending on the age of the vehicle.

Oklahoma collects a 325 state sales tax rate on the purchase of all vehicles. As of July 1 2017 Oklahoma. Your exact excise tax can only be calculated at a Tag Office.

And I dont believe they are assessed it anyway. For a used vehicle the excise tax is 20 on the first 1500 and 3 ¼ percent thereafter. 4 rows Tulsa OK Sales Tax Rate.

The current total local sales tax rate in Tulsa OK is 8517. Oklahoma has a 45 statewide sales tax rate but also has 470 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 4242 on top of the state tax. In Oklahoma localities are allowed to collect local sales taxes of up to 200 in addition to the Oklahoma state sales tax.

Together these two motor vehicle taxes produced 728 million in 2016 5 percent of all tax revenue in the state. Localities that may impose additional sales taxes include counties cities and special districts like transportation districts and special. The tulsa county sales tax rate is.

We bought our minivan in Texas for 9900. This is only an estimate. With local taxes the total sales tax.

So dont expect to pay 8 sales tax. 325 of the purchase price or taxable value if different Used Vehicle. Inside the City limits of Tulsa the Sales tax and Use tax is 8517 which is allocated between three taxing jurisdictions.

325 of taxable value which decreases by 35 annually. This method is only as exact as the purchase price of the vehicle. Returns for small business Free automated sales tax filing for small businesses for up to 60 days.

Our tax was 61875 plus the 5350 registration fee. Please note that special sales tax laws max exist for the sale of cars and vehicles services or other types of transaction. The excise tax is 3 ¼ percent of the value of a new vehicle.

Standard vehicle excise tax is assessed as follows. The vehicle information provided here is supplied by the seller or other. This page covers the most important aspects of Oklahomas sales tax with respects to vehicle purchases.

No credit card required. 2000 on the 1st 150000 of value 325 of the remainder. This is the total of state and county sales tax rates.

Sales tax in tulsa inside the city limits of tulsa the sales tax and use tax is 8517 which is allocated between three taxing jurisdictions. Tulsa County - 0367. Texas on the other hand does charge a 625 state sales tax on cars.

Our tax was 61875 plus the 5350 registration fee. This means that depending on your location within Oklahoma the total tax you pay can be significantly higher than the 45 state sales tax. The County sales tax rate is.

State of Oklahoma - 45. Also the excise tax is based on a percentage of the purchase price of the vehicle as long as the purchase price is within 20 of the average retail value for that specific model vehicle. However it must be noted that the first 1500 dollars spent on the vehicle would not be taxed in the usual way.

Motor Vehicle CARS - Online Renewal Find a Tag Agent Forms Publications.

Oklahoma Senate Advances Bill To Cut Taxes On Car Sales Involving Trade Ins Latest Headlines Tulsaworld Com

Hours Directions To Regal Car Sales And Credit Tulsa Sapulpa Muskogee Okmulgee Grove Poteau Oklahoma City North Stillwater Lawton

River Spirit Expo 4145 E 21st St Tulsa Ok 74114 Usa

Used Minivans And Vans In Tulsa Ok For Sale

Car Sales Tax In Oklahoma Getjerry Com

Used Cars Under 10 000 Near Tulsa Ferguson Kia

Oklahoma Vehicle Sales Tax Fees Calculator Find The Best Car Price

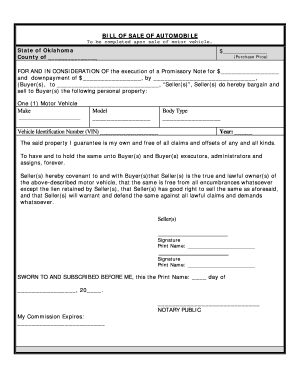

Oklahoma Vehicle Bill Of Sale Fill Out And Sign Printable Pdf Template Signnow

Used 2022 Chevrolet Tahoe For Sale In Tulsa Ok Edmunds

Oklahoma Vehicle Sales Tax Fees Calculator Find The Best Car Price

Hitch It Trailer Sales Trailer Parts Service Truck Accessories Trailers For Sale Aqua Lily Pad Lily Pads

Used 2021 Gmc Yukon For Sale In Tulsa Ok Edmunds

Buy A Used Car In Tulsa Ok Oklahoma Used Vehicle Sales

Car Sales Tax In Oklahoma Getjerry Com

The Tulsa County Oklahoma Local Sales Tax Rate Is A Minimum Of 4 867

Used 2021 Kia Seltos For Sale In Tulsa Ok Edmunds

Used 2021 Chevrolet Tahoe For Sale In Tulsa Ok Edmunds

Bob Moore Chrysler Dodge Jeep Ram Of Tulsa Bob Moore Auto Group