flow through entity irs

Every profit-making business other than a C corporation is a flow-through entity including sole proprietorships. Flow-through entities can generally make the election for tax year 2021 by specifying a payment for the 2021 tax year that includes the combined amount of any unpaid quarterly estimated payments due for tax year 2021.

Instructions For Form 5471 01 2022 Internal Revenue Service

The Department of Treasury is automatically waiving penalty and interest for the late filing of FTE tax returns due on March 31 2022.

. Log on to Michigan Treasury Online MTO to update business details authorized representative information and to file or pay tax returns. Limited liability companies LLCs that file federal income tax returns as partnerships Partnerships including limited partnerships limited liability. Some key takeaways for tax and accounting professionals include.

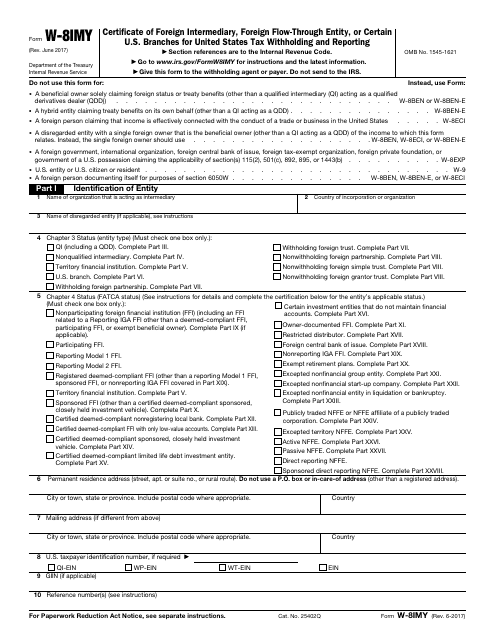

The title of this concept unit as referred to by the IRS is. Information about Form W-8 IMY Certificate of Foreign Intermediary Foreign Flow-Through Entity or Certain US. Click the payment button to initiate the payment.

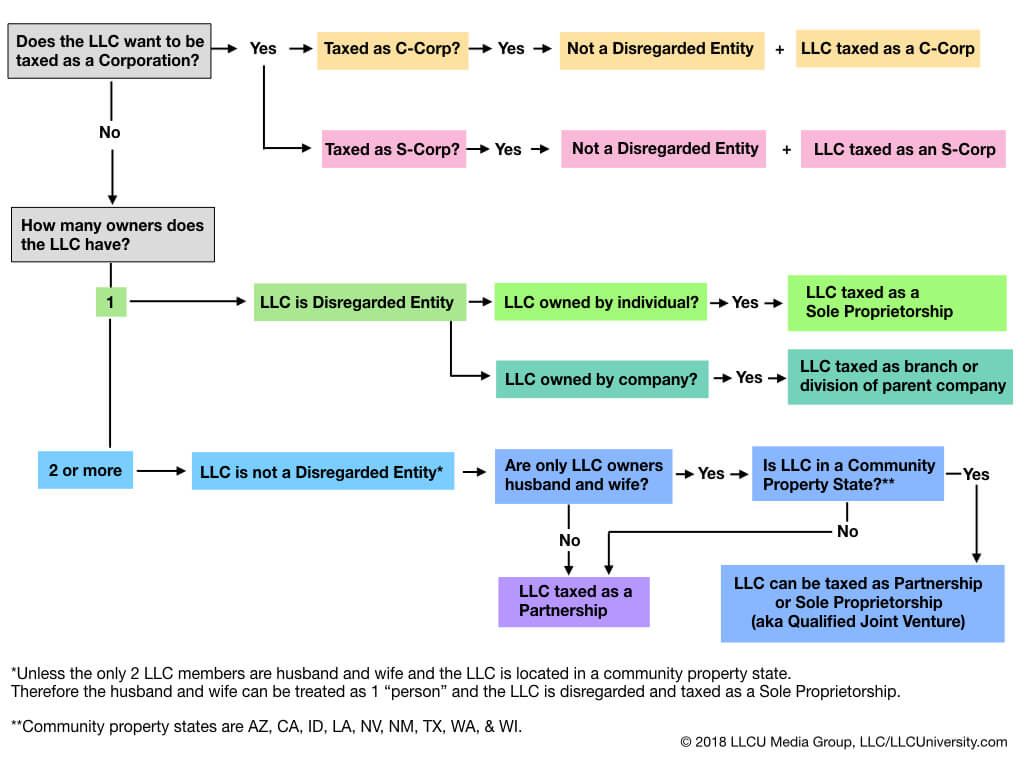

Flow-through entities can affect an individuals foreign tax credit FTC with regard to foreign-source gross income foreign-source taxable income worldwide gross income worldwide taxable income and foreign taxes available for credit. Flow-through or pass-through entities are not subject to corporate income tax though the Internal Revenue Service does require that they file a K-1 statement annually. A flow-through entity is a legal entity where income flows through to investors or owners.

Flow-through entities effects on FTC. Read the concept unit on the. Flow-through entities are also known as pass-through entities or fiscally-transparent entities.

If a payment category does not apply leave it blank. Flow-Through Entity Tax - Ask A Question. Any flow-through entity making a 2021 election after the due date of the flow-through entity tax annual return March 31 2022 for calendar year filers.

1 2021 for certain electing flow-through entities and those entities may be required to pay quarterly estimated tax payments. Define various terms including flow-through entity and business income for the purposes of Part 4. The MI flow-through entity tax is retroactive to Jan.

--Beginning January 1 2021 and each tax year after that levy and impose a flow-through entity tax equal to the individual income tax on every taxpayer with. --Define substantial nexus for the purposes of the flow-through entity tax. Flow-Through Entity Tax - Ask A Question.

The majority of businesses are pass-through entities. Its gains and losses are allocated or flow through to those with ownership interests. The most typical function of a flow-through entity is to ensure that its owners and investors are not subject to double taxation which is the case for C-corporations.

Common Types of Pass-Through Entities. Fourth quarter estimated tax payment for calendar year flow-through entities electing into the tax are due Jan. A Flow-Through Entity Tax Your Payment Select Flow-Through Enti Enter your payment amounts in the Tax Amount Penalty Amount and Interest Amount fields for each tax type below.

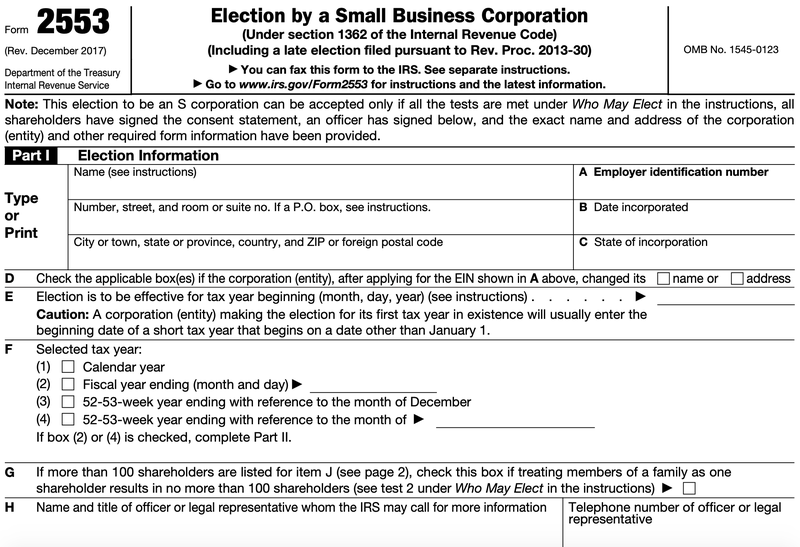

Flow Through Entity means an entity that for the applicable tax year is treated as an S corporation under section 1362a of the internal revenue code a general partnership a limited partnership a limited liability partnership or a limited liability company that for the applicable tax year is not taxed as a corporation for federal income tax purposes. These parties then report the gains and losses on their own tax returns. The resulting avoidance of.

000 Tax Type PAY Tax Amount 9 Flow-Through Entity Tax Select Pay. Branches for United States Tax Withholding and Reporting including recent updates related forms and instructions on how to file. Flow-through entity does not include.

Flow-through entities FTEs affect an individuals Foreign Tax Credit FTC by impacting foreign source gross income foreign s ource taxable income worldwide gross income worldwide taxable income and foreign taxes available for credit. The following types of common flow-through entities may elect to pay the flow-through entity tax in Michigan. That is the income of the entity is treated as the income of the investors or owners.

Trade or business and dispositions of interests in partnerships engaged in a trade or business within the United States made to a foreign flow-through entity are the owners or beneficiaries of the flo. Partner of a partnership must report the partners distributive share of the partnerships gains income deduction s losses or credits on. The waiver will be effective for a period of 6 months.

9 Notice 2020-75 agreeing that pass-through entity PTE businesses may claim entity-level deductions for state income tax paid under state laws that shift the tax burden from individual owners to the business entityThe guidance clarifies uncertainty on the issue and supports partnerships and S corporations deducting tax payments. A pass-through entity also known as a flow-through entity is not a particular business structure but a tax status enjoyed by any business that does not pay corporate tax. The payees of payments other than income effectively connected with a US.

A flow-through is a business entity that may generate or receive taxable income but which pays no income tax in its own right. Form W-8 IMY may serve to establish foreign status for purposes of sections 1441 1442 and 1446. More states considering passthrough entity taxes February 2021 IRS allows entity-level taxes as SALT deduction limitation workaround November 2020 California Senate bill proposes pass-through entity tax January 2021 Connecticut enacts responses to federal tax reform affecting corporations pass-through entities and individuals June 2018.

The IRS released guidance on Nov. Through entity receiving a payment from the entity I certify that the entity has obtained or will obtain documentation sufficient to establish each such intermediary or flow-through entity status as a participating FFI registered deemed-compliant FFI or FFI that is a QI. Common types of FTEs are general partnerships limited partnerships and limited liability partnerships.

Irs Form 945 How To Fill Out Irs Form 945 Gusto

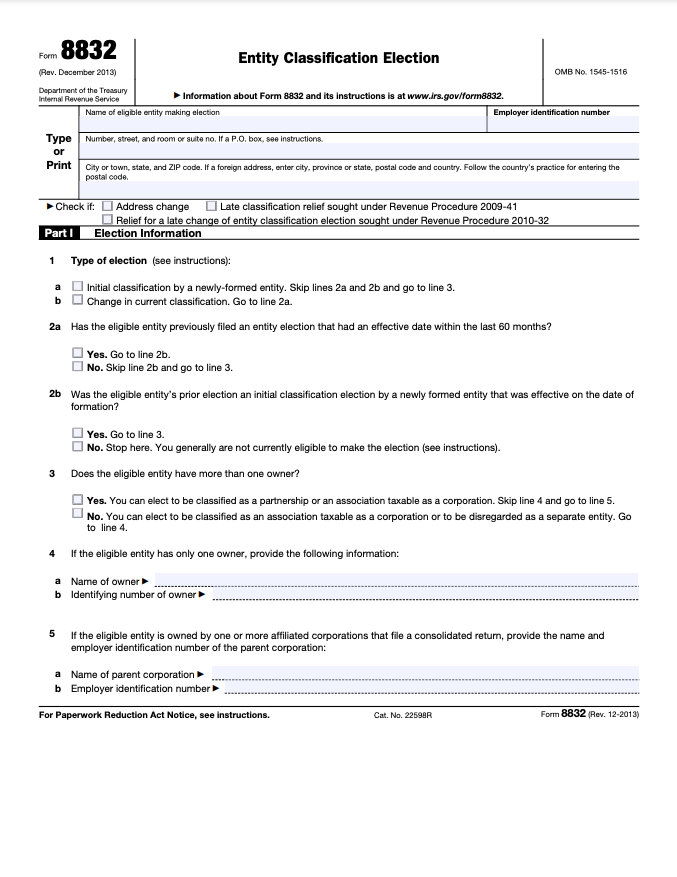

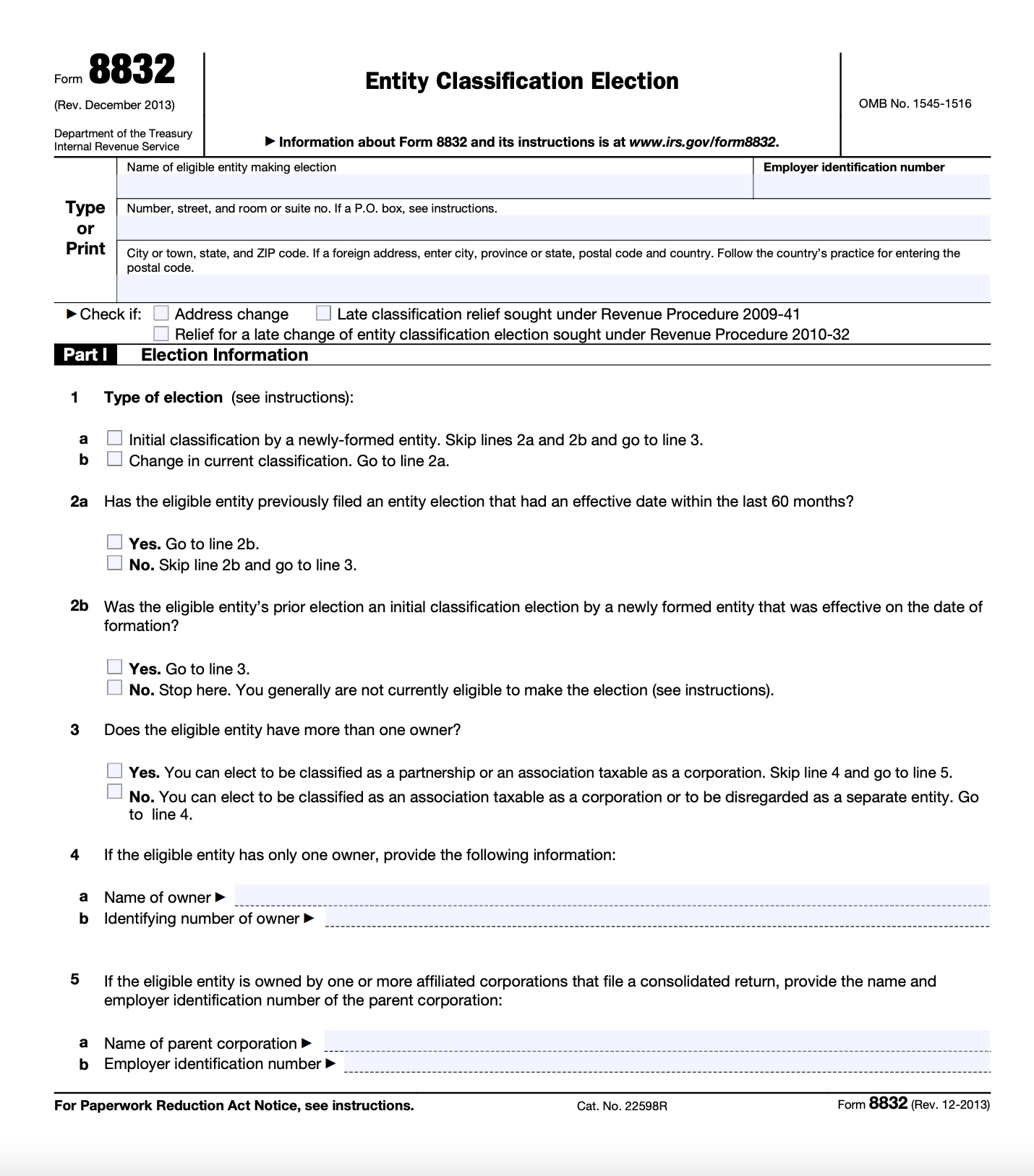

Form 8832 And Changing Your Llc Tax Status Bench Accounting

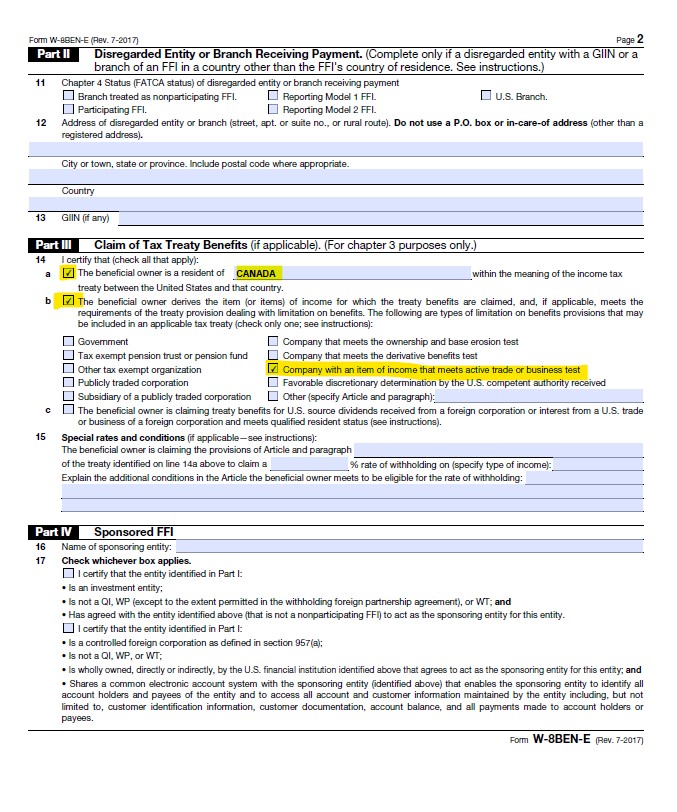

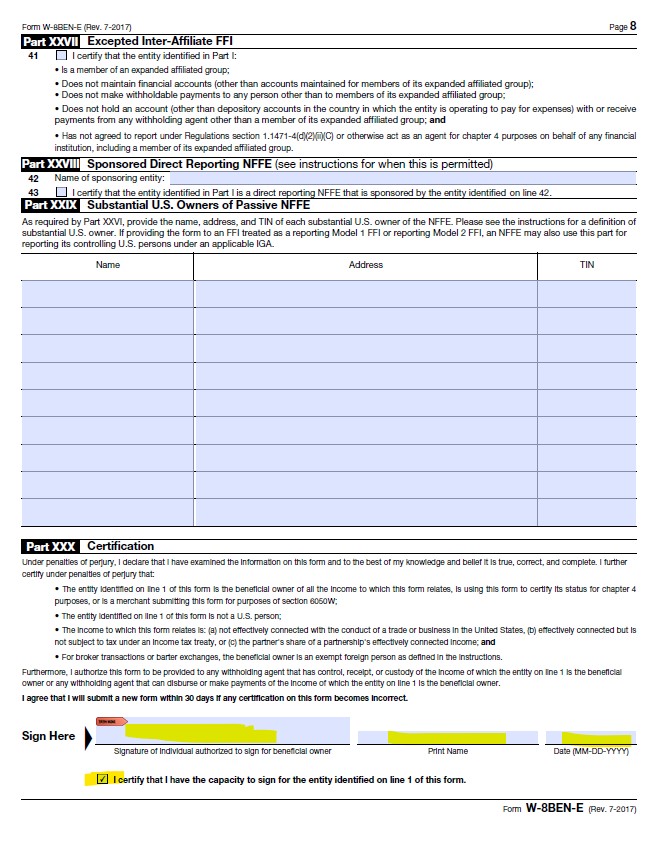

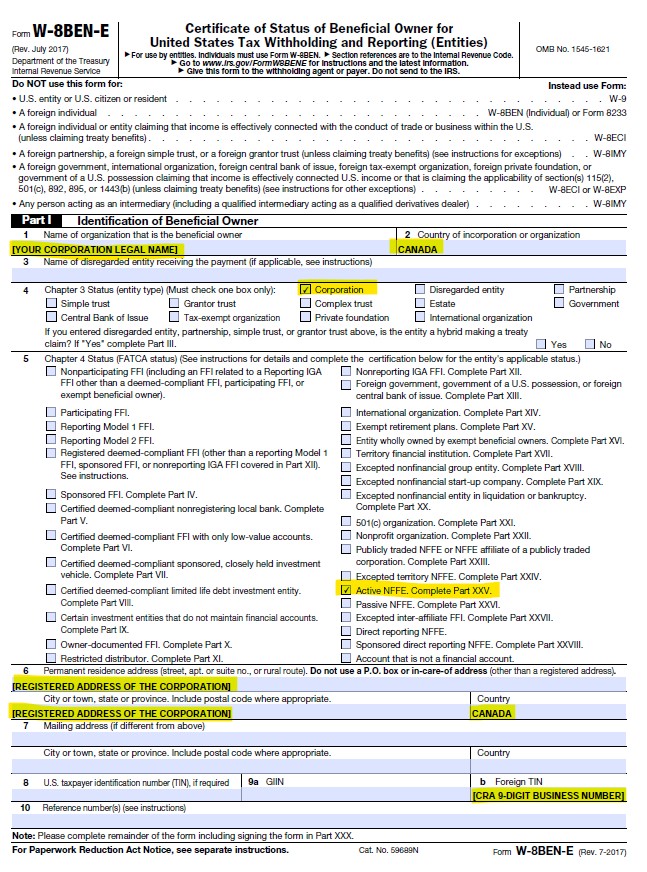

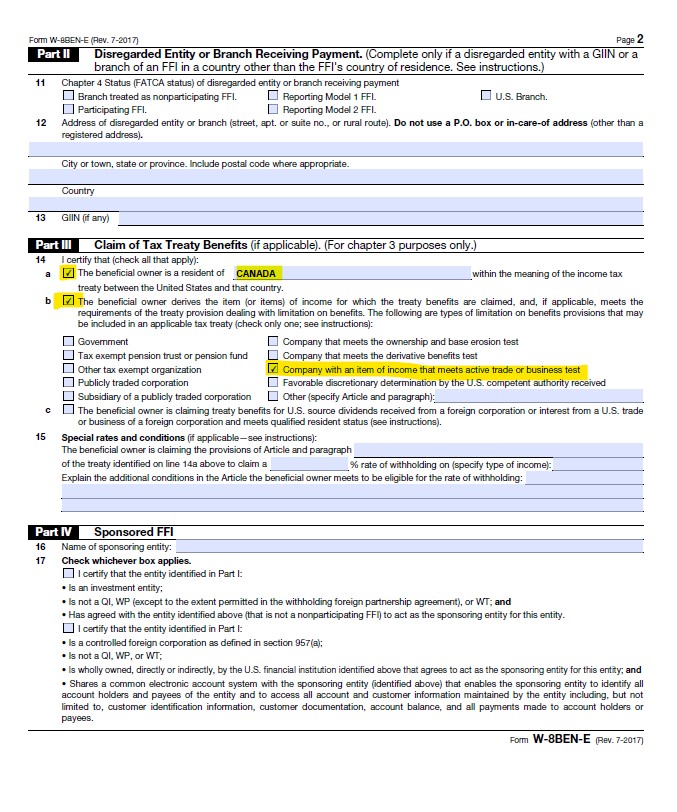

W 8ben E For Canadian Ecommerce Sellers Faqs Sample Baranov Cpa

Irs Form W 8imy Download Fillable Pdf Or Fill Online Certificate Of Foreign Intermediary Foreign Flow Through Entity Or Certain U S Branches For United States Tax Withholding And Reporting Templateroller

W 8ben E For Canadian Ecommerce Sellers Faqs Sample Baranov Cpa

A Beginner S Guide To Pass Through Entities The Blueprint

Llc Taxed As C Corp Form 8832 Pros And Cons Llc University

What Is A Disregarded Entity Llc Llc University

3 Changes You May See On Your 2019 Partnership K 1s And Why They Matter Cohen Company

Filing Personal And Business Taxes Separately A Small Business Guide

W 8ben E For Canadian Ecommerce Sellers Faqs Sample Baranov Cpa

Form 8832 How To File The Forms Square

Instructions For Form 5471 01 2022 Internal Revenue Service

Irs Form W 8imy Download Fillable Pdf Or Fill Online Certificate Of Foreign Intermediary Foreign Flow Through Entity Or Certain U S Branches For United States Tax Withholding And Reporting Templateroller

How Should An Llc Fill Out A W 9 Form Correctly Ssn Vs Ein W9manager

What Is A Disregarded Entity And How Are They Taxed Ask Gusto

How Should An Llc Fill Out A W 9 Form Correctly Ssn Vs Ein W9manager